Rich Dad Poor Dad 3 Day Training Reviews

Is Robert Kiyosaki'southward Rich Dad Poor Dad Grooming Worth It?

Rich Dad Poor Dad is a cornerstone resource for the modernistic belongings investor and is synonymous with its writer and financial businessman Robert Kiyosaki. Recently attending a free Rich Dad Poor Dad seminar, I was introduced to a three day form run by UK based Legacy Alliance Education.

I decided to attend this course. If yous Google "Rich Dad Poor Dad courses" you'll come up across a number of positive and negative reviews. Hither, I'll share what I learned over 3 days and help you lot decide whether it'due south worth your time and money.

Just a note: I am not nor claim to be a property or investment expert. What I share below is what I learnt over the 3 mean solar day class. Information technology aims to give insight then that y'all are equipped to make your ain decision on whether this grade is right for you.

Highlights of the Rich Dad Poor Dad Course

July 21-July 23 2017, Melbourne

Mindset and Your 'Why'

Property is all nearly people. Surviving the ups and downs of property requires the right mindset in order to overcome whatever trough of sorrow. For more on adopting a positive mindset, you tin can read my mail here.

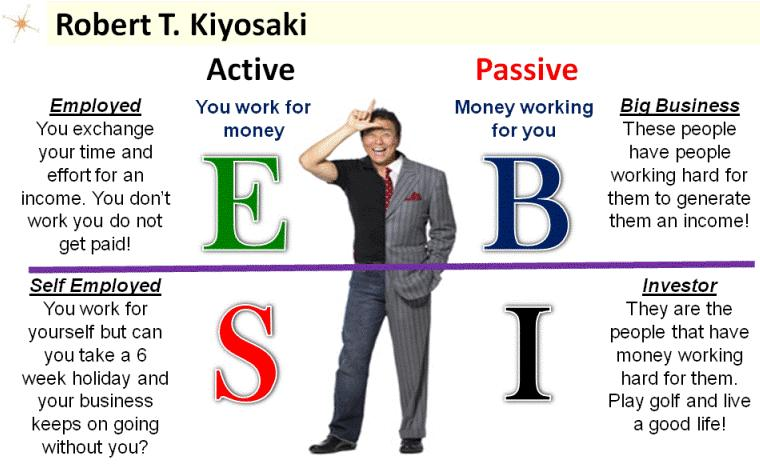

Introduced was Kiyosaki's EBSI concept (run across below) which explains that to be successful, we need to rid of the scarcity mindset and move towards abundance. That is, "y'all must unlearn what y'all have learned" to move from stages East, S or B towards I (Investor).

Employed throughout the three days was also discussion of the presenters 'why' — why they got into holding investment. Their whys included family and giving back to the community.

Leverage

Leverage other people's resources; time, money, skills and location. Leveraging successfully involves adopting Kiyosaki's vii Rules of Ownership which was carried throughout the form:

- Always make coin in the Buy; that is, buy under market value and add value

- Add together value

- Have multiple leave strategies (recommended to have at least ii)

- Exist Legal

- Brand Offers

- Have Integrity

- Trust in the Power of Your Squad (Legacy's Power Team — volition be explained further)

Number Crunching Time!

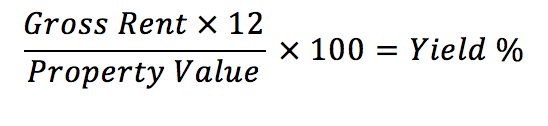

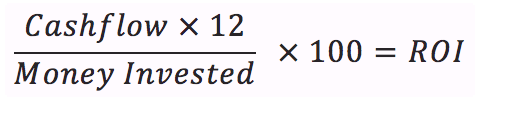

Teaching some of the Rich Dad Poor Dad calculations was a crucial part of the training, in social club to develop the ability spot a 'good deal'. These formulas included:

Cashflow: Net rent — Mortgage Payment (notation cashflow can be negative (-) or positive (+))

Determining cashflow includes management fees and MOE (Monthly Operating Expenses). For calculation purposes they were causeless at ten% of monthly hire. Examples include: insurance, torso corporate, repair costs, legal fees etc..

Gross Yield:

ROI (Return on Investment):

Australian Market place Conditions

Take annotation that although Legacy do explore Australian Market atmospheric condition, the premise of the Rich Dad Poor Dad preparation is to invest in the UK or New Zealand. This is due their familiarity of the market conditions and tax and lending atmospheric condition.

When considering this course in another country, be mindful that focus will exist on that country or other related markets.

"Success does not come up in the coin you lot make, it's the coin you lot keep."

Melbourne belongings yields are low, due to current stabilisation of the Australian market. There is an oversupply of property (high build rates) even so slowing demand.

Tools Recommended for research:

- Realestate.com

- Numbeo

- Global Belongings Guide

Crazy Financing

Finding a 10% deposit locks out a lot of buyers in the Australian market, particularly millennials. Obtaining funds from institutional and individual sources was briefly explored, with focus on artistic or crazy financing.

Funding through an expansion of credit (credit cards) whilst reducing fees and interest rates via 0% balance transfer schemes was endorsed for investment. How to pay it back?

- Selling post-obit value add

- Cash equity

- Refinance

"The quality of your network is the amount of your internet worth".

Strategy

Towards the middle of the 3 days, exploration of investment strategy took place. Hither passive or active approaches were examined:

Active: Is a flip strategy whereby property is purchased under market value, value is added (renovation) so sold for turn a profit. Buy and flips were recommended to have at least $30,000 inside the bargain every bit a minimum starting point.

Creating a pot of cash: Building a hybrid portfolio which includes a number of ongoing flip properties and a passive income property. (Ie. 3 flip properties on the go and 1 reserved just receiving rent)

Passive: based off dissimilar property types: buy to allow (BLT), multi permit, home of multiple occupants (HMO) or commercial property. Each property blazon has their own return, the higher the return the initial investment required.

"Buy average houses for everyday people".

U.k./ New Zealand

The last day included assay of lending and taxation laws and weather in the Britain and New Zealand. In summary, reasons for investment in the Britain/New Zealand over Commonwealth of australia is due to:

- Australian lending is based on the person's cashflow (income in relation to borrowings), where as in the UK lending is based on the person's cashflow (income of at least £25,000) and of the property (100–125% positive cashflow (hire) in relation to borrowings)

- Australian taxation (stamp duty, company tax rates, capital letter gains tax). New Zealand simply has income and GST taxes.

- Lower yields in Australia due to high supply

Mentorship

"(Be) Fearful when others are greedy and greedy when others are fearful." — Warren Buffet

While the Rich Dad Poor Dad class was useful; sprinkled throughout the iii days were remarks of a mentorship program. Interested mentees would pay $35,000-$62,500 AUD for a farther iii 24-hour interval intensive, 30 day mentorship and lifetime support within Legacy.

Each topic explored covered a level of detail but at a certain bespeak would end with "this will be covered more in the mentorship". Furthermore it was on Day 3 that the prices of the mentorship were given along with the recommended deposit of $50,000 AUD to offset the program.

Is it Worth it?

Exploring some of the high level detail on the Rich Dad Poor Dad grade above, is it worth your time and big financial investment?

Pros

- High level introduction to lending and property

- Computing cash flow, yield and ROI

- Power to bounce ideas or questions off experienced investors — who are the mentors and presenters

- Examples of 'expert deals'

- Some interactive activities

- Networking opportunities

- Give-and-take across property- people'due south whys, mindset, negotiation

Cons

- Fiscal investment — Initial cost of 3 day course, followed by $35-$63K investment in mentorship

- Course was not clearly outlined on 24-hour interval i — no syllabus or calendar

- Unused course materials

- Very long days (9am — 7pm average) with improper breaks and bereft interactive activities

- Mentorship cost and starting position of $50K was not mentioned until twenty-four hours 3

- Continually plugging of mentorship plan — the 3 day grade itself did not promote self investment Eg. sourcing property under market value is key to this model, yet how to source under market value properties is not taught.

- Presenters spend too long talking about themselves and how marvellous their lives are

Overall

Unless yous take a spare $90,000 lying around there is express value in attending the iii day Rich Dad Poor Dad form. This is the same for pursuit of the mentorship program.

Whilst there is value in obtaining investment cognition in the iii day class, the free 1 hour seminar produces plenty of wisdom nuggets and forms a good starting betoken.

I chose to non buy the mentorship programme purely due to a dissimilar why — money is not my main determinant of my why. I'd definitely requite credits to the Legacy team for seamlessly employing Oren Klaff'south 'Pitch Annihilation' techniques such as scarcity and emotional levers to get people to purchase.

In terms of value for money and time (16 hours over 3 days), reading Rich Dad Poor Dad and Cashflow Quadrant would exist as equally as useful in conjunction to personal research if property investment is the next path in your reinvention.

Source: https://storiesbytrinh.medium.com/is-robert-kiyosakis-rich-dad-poor-dad-training-worth-it-174828d79e0